| Comparative Report of olive oil markets |

|

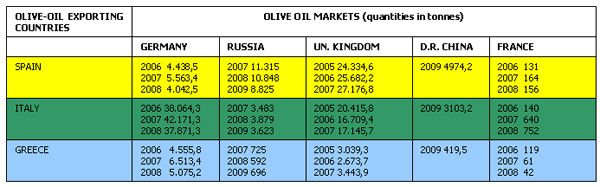

Spain is the largest olive oil producer at European and global level, who managed to double its production after 1990, following policies designed by low-cost production, earned a prominent place in the international market. Thus, world prices of olive oil determined by the values of the markets of Spain, Italy end finally of Greece. Spain seeks ways to promote its products in some emerging markets or in countries such as West Africa and Chile and in the areas of catering, gourmet products, distribution chains in major food and hotel businesses. Italy is the second world producer of quality olive oil with a national production average of more than 600.000 tons, ranking 39 extra-virgin olive oils of Protected Designation of Origin (PDO) and 1 of Protected Geographical Indication (PGI) recognized by the European Union. The domestic market traditionally devotes particular attention to quality olive oil by supporting research and selection of best practices aimed to ensure best organoleptic and olfactory results (panel test). A major effort is being made to define consortium production methods in order to offer consumers a high quality olive oil at competitive prices. Export policies are increasingly focused on the American market and, more recently, on the growing demand for edible oils coming from emerging markets such as China and India. Greece occupies after Spain and Italy the third place in worldwide production of olive oil and has more than 140 million olive trees who produce approximately 360,000 tons of olive oil annually, where 75-80% is extra virgin olive oil. This rate makes Greece the largest producer of extra virgin olive oil and offers a reasonably useful comparative advantage (Italy has the second place with a rate of 40-45% and Spain has the third place with 25-30% share of annual production in virgin olive oil). Below is a comparative confrontation of five countries whose markets constitute olive oil import terminals.

|